how to open tax file in bangladesh

For Tax Submission in Bangladesh each assessee shall deposit the amount to the govt after assessing the amount of income tax. As per section 44 2 b of the Income Tax Ordinance 1984 an individual taxpayer will get tax rebate at 15 if the taxable income is upto BDT 1500000.

Average Price Per 20 G Of Smokeless Tobacco Per Pack Of Bidis And Download Scientific Diagram

C if the person is-.

. Complete and submit an application form which can be found here link is external to. In Bangladesh withholding taxes are usually termed as Tax deduction and collection at source. Enter a unique user ID password a security question answer mobile number email ID and then verify the Captcha code and click on the Register button.

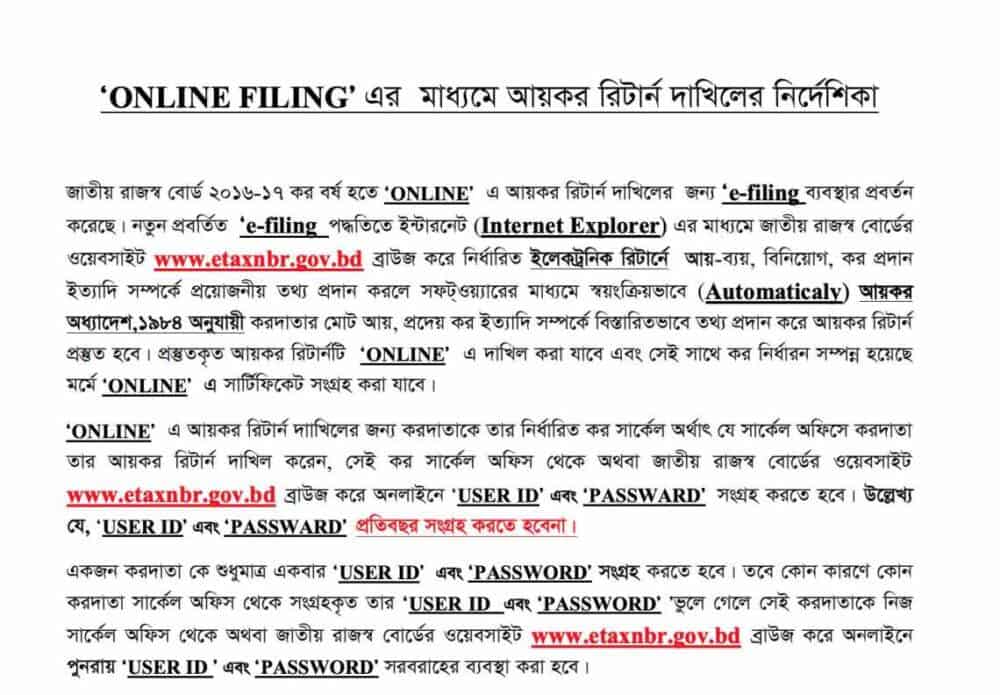

Choose the online account application form and clicks the link Click here. The government earns by levying tax on the income generated by the population. A code is sent to the number and this code shall be used to obtain User IDPassword.

B In this case a certificate from the Bangladesh embassy in that country as. Log in to the Online Filing System. Certificate of tax collected at source Doc Certificate of tax collected at source Pdf Certificate of tax deducted at source Doc Certificate of tax deducted at.

B if such person was assessed to tax for any one of the three years immediately preceding that income year. Exchequer by pay order challan treasury or online via wwwnbrepaymentgovbd and submit duly signed and verified return form along with the necessary documents to the tax circle concerned. Obligation to file tax return.

And at 10 if the taxable income exceeds that limit. You can calculate yo. Otherwise she will be complied to pay 2 monthly delay interest even if she applied for time extension with the DC of Taxes.

Every individual must submit hisher income tax return to the concerned Deputy Commissioner DC of Taxes from 1 July to 30 November 2016. From the homepage Taxpayer clicks Register Account tab. Return-Business Professional income upto 3 Lakh- IT11CHA.

The government on 7 May 2020 approved draft legislation to extend the time for taxpayers to file their tax returns and to pay their taxes as relief measures in response to the coronavirus COVID-19 pandemic. As per the requirement stated in the Finance Act 2017 if any person earned more than Tk. Select Open Tax Return from the File menu Windows or TurboTax menu Mac browse to the location of your tax or tax data file not the PDF select it and then select Open.

13 Tax withholding functions. Time limit to submit the return and supporting documents. AHM Belal Chowdhury Financial Lead of FM Consulting International speaks about Tax Assessment Fillings in BangladeshThis video is about a brief descripti.

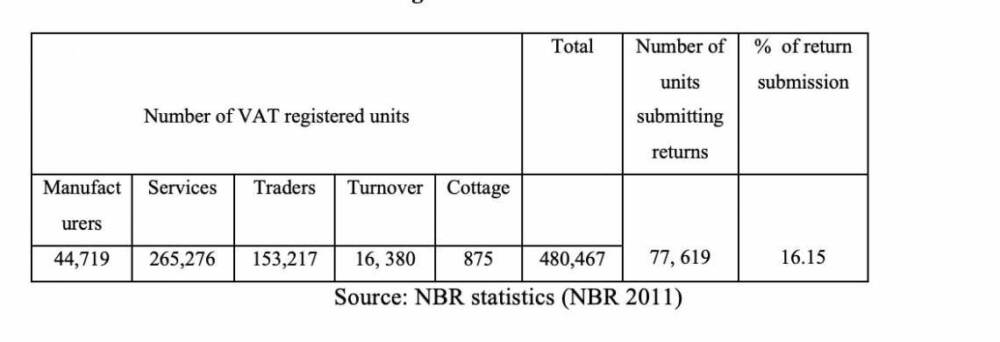

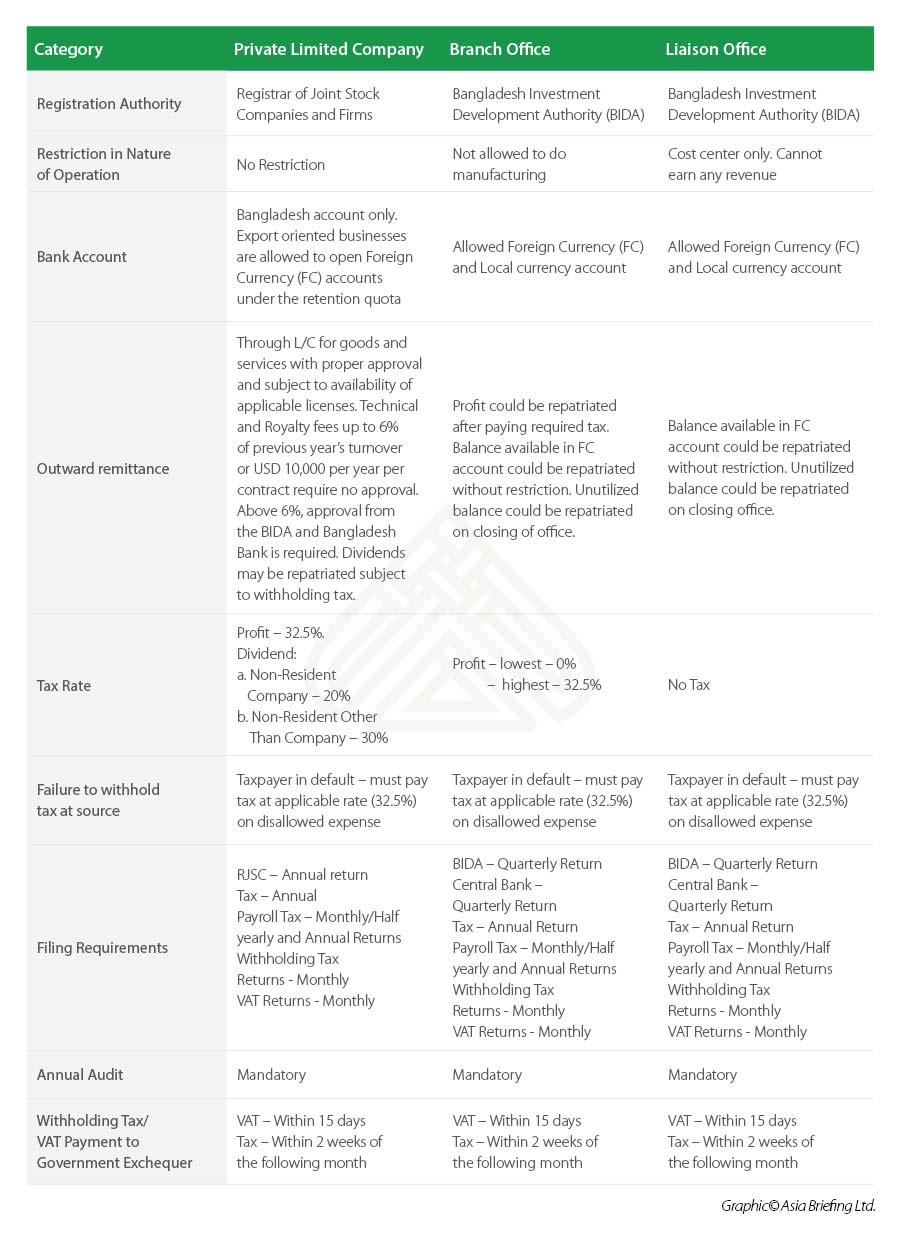

The tax law imposes income tax at 25 percent on listed entities and 325 percent for non-listed entities. An overview of Individual Income Tax in Bangladesh. A countrys great source of income is its population.

An individual can follow two procedure to file the return one is universal self assessment procedure and normal procedure. Please note that youll need to use the same tax-year TurboTax program to open. Out of this profit only income tax will generate 8500000 million taka which is 111.

As per the stipulation stated in the Finance Act 2014 if any person earned more than Tk 220000 during the income year 2013-14 then she has to file hisher income return along with the sources. A reduction of the corporate income tax rate for companies in the readymade garments sector to 15. A if the total income of the person during the income year exceeds the minimum tax threshold under this Ordinance.

25 of total taxable income. Income tax calculation and preparation of tax return is a complex task for a non-professional. Separate draft legislation to amend the value added tax VAT rules has been approved allowing the National Board of Revenue NBR to.

Abroad in the name of any Bangladeshi living in Bangladesh. Access the online tax filing system here link is external. Our taxation services at FM Consulting International ensure both advantage to the individual and compliance according to Bangladesh taxation policy.

As your taxable income is below BDT 1500000 so you will get tax rebate 15 on the full investment allowance. Click Continue under the return you want to open or. The system displays an online account registration application and Taxpayer saves application form to his computer.

Corporate tax rate changes announced this year include. Apply for an e-TIN. Time limit to submit the return.

A taxpayer can file an appeal against DCTs order to the Commissioner AppealsAdditional or Joint Commissioner of Taxes Appeals and to the Taxes Appellate Tribunal against an Appeal order. The following is a step by step guidelines on the individual income tax return filing in Bangladesh. At First Visit the Website httpssecureincometaxgovbdTINHome Create a User ID by proving necessary informations in the Registration form In order to obtain a User ID and password to open an account a phone number needs to be provided to the portal.

It is a system guided easy-to-use tax preparation. Step 01 Click on this link IncomeTaxGovbd and fill-up the form like the image below. A person shall file a return of income to the DCT of the income year.

250000 during the income year then that person needs to file. Any non government organization registered with NGO Affairs bureau. An additional surcharge of 25 percent on income of companies in the tobacco sector.

In this video I will show Income from house property Income tax return filing 2020-21 in Bangladesh how to file house property income. Taxpayer accesses the address httpetaxnbrgovbd. To make the IT return form user friendly tax calculator would be a tool which leads to the taxpayers to reach their total income in steps and auto calculation of net tax amount to be paid.

In order to verify a persons status of income. Well first look into your amount of investment and how much qualifies for a tax rebate check the excel file for calculation. The name and address of the consignee shall be mentioned in the import documents in such case- aNo permission or import permit from the Import Control Authority shall be necessary.

Step 02 You will get an activation code on your Mobile Phone. In the budget for the 2006-07 fiscal years government had estimated total tax revenue of 42915450 million taka including both NBR and non NBR revenue of total receipt of 76558618 million taka which is 616 of total receipt of the country. An individual must file tax return within 30th November with all related supporting documents.

The amount of investment that qualifies for tax rebate is the lesser of. After launching the TurboTax program you can either. Tax In Bangladesh Step 1.

The tool will help the taxpayers to calculate income tax and.

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Online E Tin Registration And Income Tax Return 2021 22

Government Of The Peoples Republic Of Bangladesh

Tiered Excise Tax Rates For Bidis In Bangladesh 2009 2015 Download Table

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

How To Register For E Tin Etin In Bangladesh Just In 10 Minutes

Bangladesh Tax Return Filing And Tax Payment Relief Kpmg United States

Online E Tin Registration And Income Tax Return 2021 22

How To Register For E Tin Certificate In Bangladesh Roy Associates

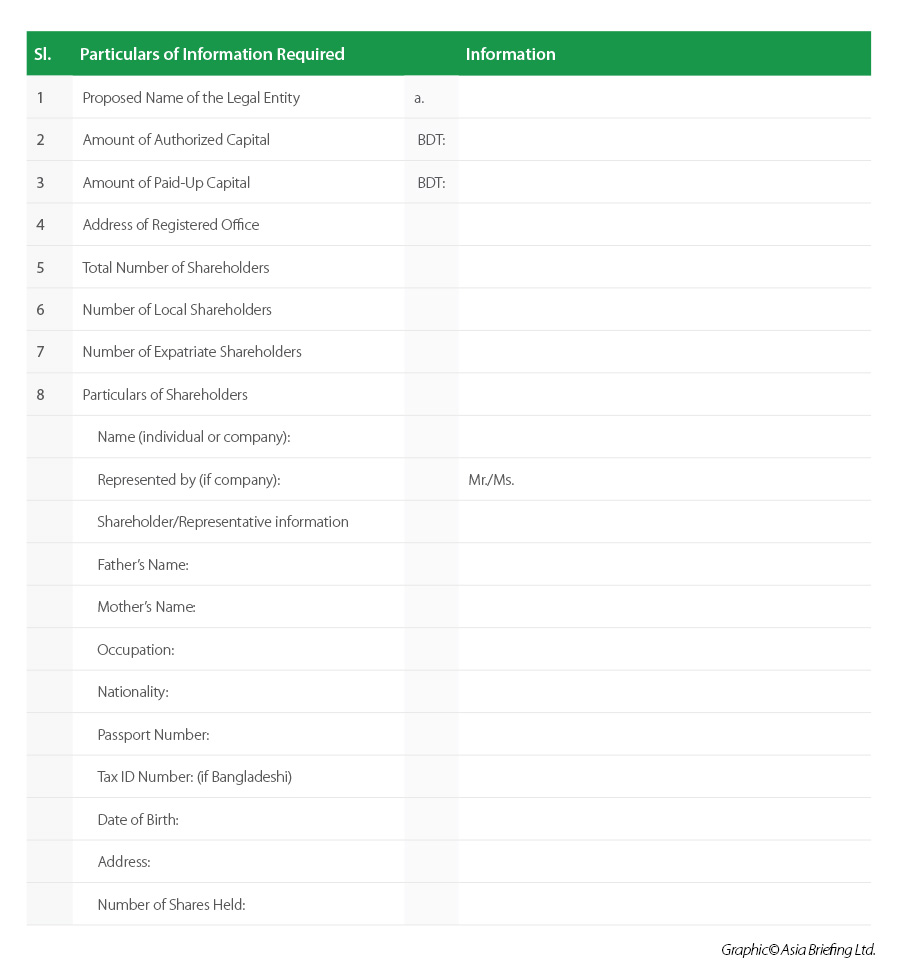

Starting A Business In Bangladesh Common Legal Entity Options

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Sanchayapatra Customers To Get Tax Certificates Online

Starting A Business In Bangladesh Common Legal Entity Options

Tin Certificate Pdf Government Of The People S Republic Of Bangladesh National Board Of Revenue Taxpayer S Identification Number Tin Certificate Tin Course Hero

How To Upload Digital Signature Certificate Dsc For E Filing Your Income Tax Return Itr